Upload photos of receipts to add expense records automatically.Īttach physical proof of expenses for assistance during tax filing season. Sort the records automatically into tax categories for minimizing time and effort. Intelligently import and classify transactions from PayPay, Square, bank accounts, credit cards and even photos of receipts to match with expenses and income. Use simplified dashboards for tracking and reporting finances.

Generate comprehensive reports on parameters such as profit and loss, tax summary and other details for insights about your business. Use simplified tax-calculation tools to avoid discrepancies during year-end tax time. Independent contractors, self-employed professionals and freelancers have the obligation of making quarterly tax payments based on estimated earnings. Create rules to automatically group similar transactions to save timeĭetermine estimated quarterly taxes automatically Independent contractors can organize financial records easily to accurately track income and outgo for business and personal use.Īllocate financial records to the appropriate sections for simplified IRS reporting and maximize tax savings. Separate transactions into “personal” and “business” types when using the same bank accounts or credit cards for all purposes. Personal and business accounts segregation QuickBooks Small Business is a part of QuickBooks Online.

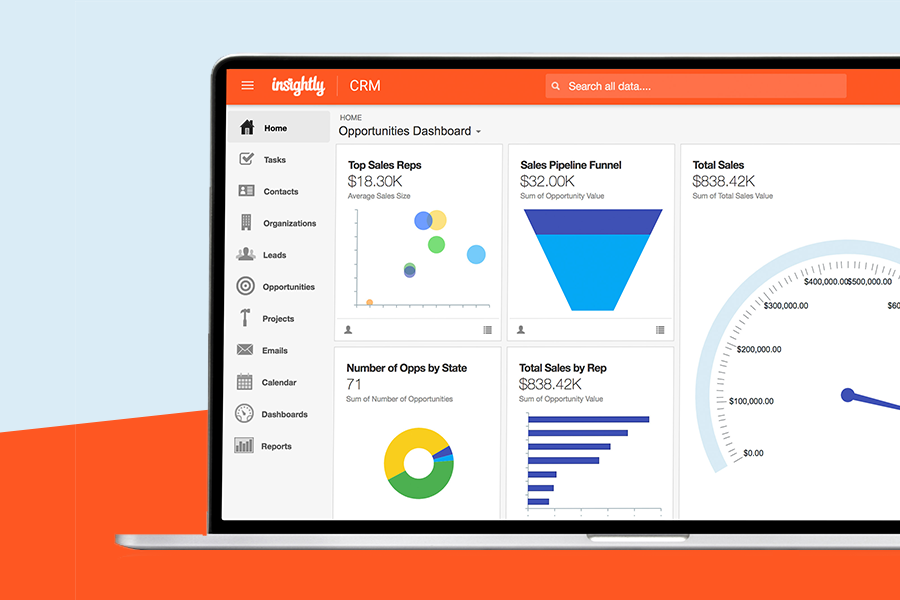

Though both QuickBooks Online Small Business and Self Employed are cloud-based, QuickBooks Self Employed is a different product than QuickBooks Online. Here, we will compare the features of QuickBooks Self-Employed and QuickBooks Online Simple Start, the basic version of QuickBooks Small Business. While QuickBooks Self-Employed is the ideal software for freelancers, QuickBooks Small Business is useful for sole proprietors, LLPs, partnerships, non-profits and other such small entities. Businesses can get instant insights into their profitability and make smart decisions to maximize profits. With a user-friendly dashboard for tracking income and expenses, all you have to do is link your accounts to capture all the transaction details without manually entering them.Ĭontrolling costs has never been easier with interactive dashboards and informative reports. It provides smart tools for handling business and personal finances. QuickBooks is one of the most preferred accounting software for freelancers and small businesses for their accounting needs. QuickBooks Self Employed vs QuickBooks Small Business – Comparison

0 kommentar(er)

0 kommentar(er)